Fiat-to-Jeep owner Stellantis is quietly resurrecting diesel versions of at least seven car and passenger van models across Europe as it retreats from electric vehicles, according to a review of dealer websites and company statements to Reuters.

In a previously unreported strategic shift, world No. 4 automaker Stellantis began in late 2025 to reintroduce diesel versions in Europe for models ranging from various passenger vans to the Peugeot 308 and premium DS No. 4 hatchback.

Related: Global Carmakers Book $55 Billion Hit From EV Rollback

EV sales have lagged expectations, and the shift comes as Europe waters down emissions targets that would allow combustion engines to stay around for longer.

The United States, Stellantis’ main market, is also retreating from EVs under President Donald Trump, whose administration this week repealed a scientific finding that greenhouse gas emissions endanger human health, eliminating car and truck tailpipe emissions standards.

“We have decided to keep diesel engines in our product portfolio and – in some cases – to increase our powertrain offer,” the company told Reuters in a response to the news agency’s findings.

“At Stellantis we want to generate growth, that’s why we are focused on customer demand.”

Competitive Advantage Vs China Rivals

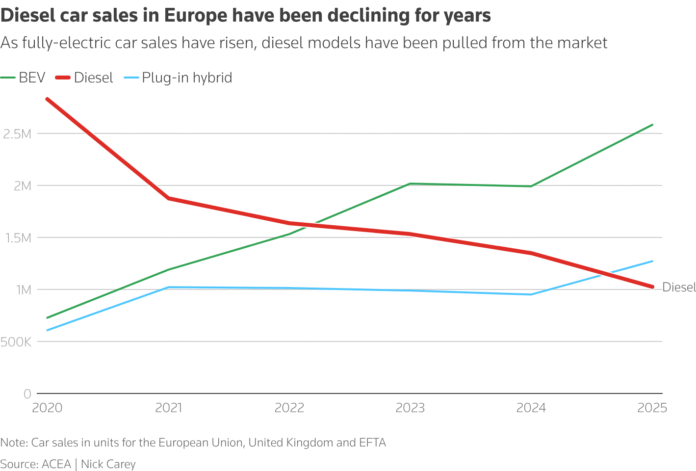

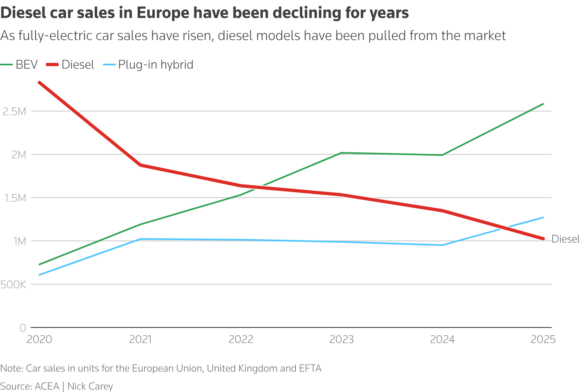

As recently as 2015, diesel vehicles made up at least 50% of new car sales in Europe but they have been declining since the ‘Dieselgate’ scandal that year, when some of the world’s largest carmakers were found to have manipulated emissions tests.

According to data from European car lobby group ACEA, diesel vehicles made up just 7.7% of new car sales across the continent in 2025, while fully electric cars accounted for 19.5%.

Many automakers have shelved diesels altogether, while Stellantis itself offers only a handful of models versus dozens just five years ago.

But crucially, it is a segment where rising Chinese rivals specializing in EVs do not compete. Diesels also carry a much lower price tag than fully electric models – giving them a competitive advantage at a time when carmakers are struggling.

Stellantis last week announced 22.2 billion euros ($26.4 billion) in charges as it scales back its EV ambitions, sending its shares to their lowest since the group’s 2021 creation through the merger of Fiat Chrysler and Peugeot maker PSA.

The company previously said fully electric cars should make up 100% of its European sales and 50% of U.S. sales by 2030, but demand in both markets has fallen short of expectations.

Related: Elon Musk Alone Can’t Explain Tesla’s Owner Exodus

Stellantis has already brought back popular combustion-engine models like the Jeep Cherokee and its powerful ‘Hemi’ eight-cylinder engine as part of its strategy to regain U.S. market share. Last year it added a petrol hybrid version of the Fiat 500 alongside an electric version.

In Europe – where the company’s sales fell 3.9% in 2025 and 7.3% in 2024 – diesel versions of the Opel Astra, Opel Combo van, the seven-seater SUV Peugeot Rifter, the Citroën Berlingo passenger van and others are being brought back, Reuters found.

It will also continue producing diesel-powered models like the premium DS7 SUV, and the Tonale and Stelvio SUVs and Giulia sedan from Alfa Romeo “in response to sustained customer demand,” the company said.

“Bucking The Trend”

Data from online marketplace CarGurus shows total new diesel models in the U.K. have also fallen, to 57 in 2025 from 167 in 2020. Collectively, the brands Stellantis sells in Britain, for example, offer just four diesel models today, down from 26 in 2020.

“If you look at the direction of travel when it comes to diesel, Stellantis now seems to be bucking the trend,” said Chris Knapman, CarGurus’ U.K. editorial director.

Knapman said diesel still makes sense for car buyers that need to drive long distances without refueling or who need more power to tow trailers.

“Also, Chinese car brands are coming in with lots of new electric and plug-in hybrid cars,” he said. “If you’re a European brand looking to differentiate yourself, diesel is an area where you could have a competitive advantage over those newer brands.”

(Reporting By Guillaume; Editing by Nick Carey, Adam Jourdan and Kirsten Donovan)

Want to stay up to date?

Get the latest insurance news

sent straight to your inbox.